estate tax changes in reconciliation bill

House of Representatives introduced a reconciliation bill that includes significant changes to estate gift and generation-skipping tax laws. A 5 surtax on individual income in excess of 10 million per year with an additional 3 on income in excess of 25 million.

Meet The Republicans Who Voted No On The Tax Bill Roll Call

The 117M per person gift and estate tax exemption will remain in place and will be increased.

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

. Growth and Tax Relief Reconciliation Act of 2001 EGTRRA. An individual rate increase to 396 and top capital gains rate increase to 25 as proposed in the Ways and Means bill are doubtful since Sen. Effective January 1 2022 Net Investment Income Tax Expanded 138203 Additionally the current tax is 38 of the lesser of NII or the excess of.

Instead it contains three primary changes affecting estate and gift taxes. The clock would start after Dec. If the bill passes impacted IRA owners will have two years to make the change or face full taxation of all assets in the IRA.

On September 27 the US. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Thursday 04 November 2021.

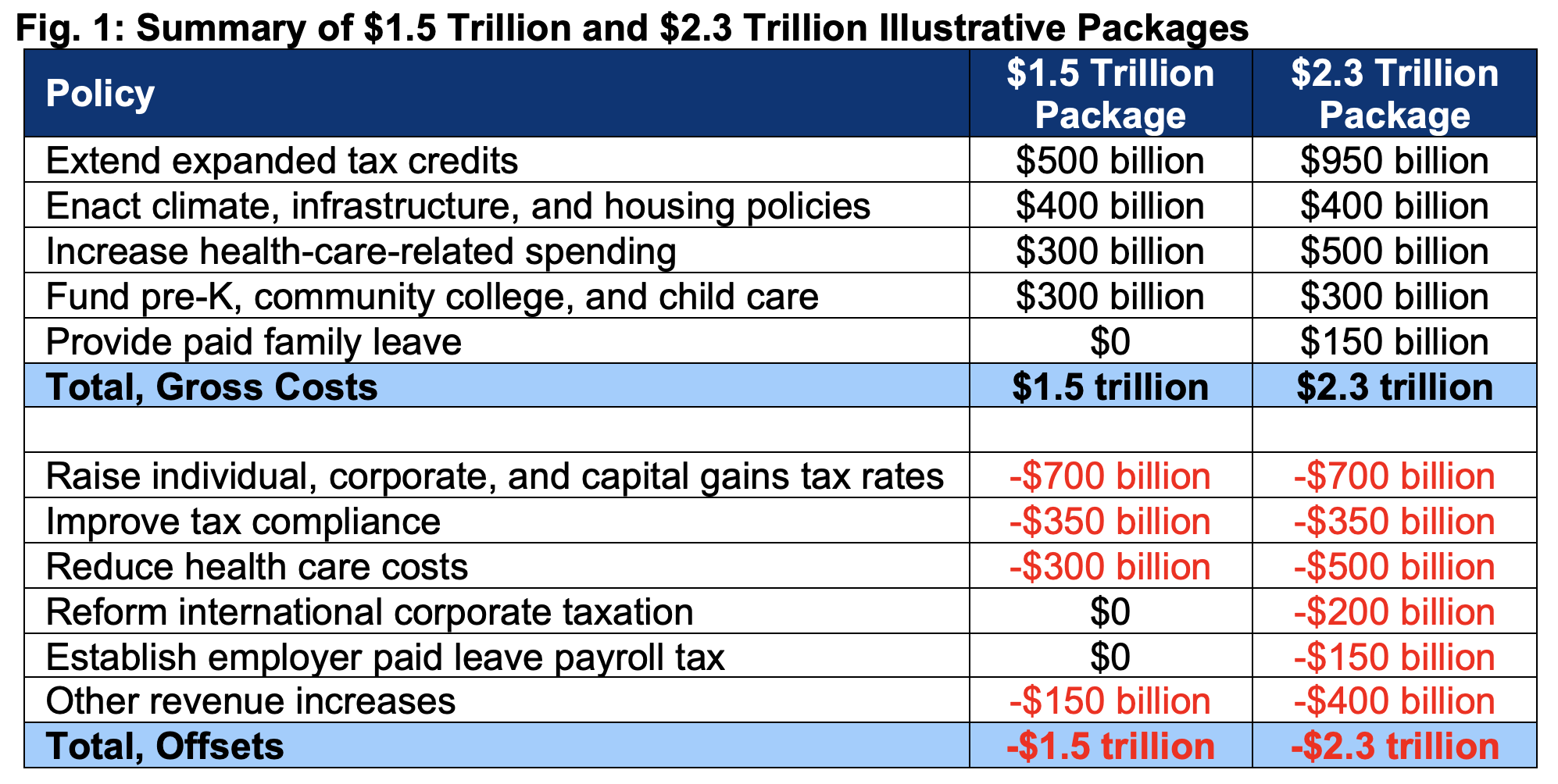

As negotiations over spending and taxes in a potential budget reconciliation bill tentatively the Build Back Better Act are ongoing in. The tax bill dropped Monday by Democrats on the House Ways Means Committee includes an array of changes to estate assets trusts corporate taxes and business. The Build Back Better Framework released.

Estate and gift tax exemption. Most of the relevant proposals in the reconciliation bill would be effective as of the date of enactment or as of January 1 2022 whichever is later. The latest draft of the US Congress budget reconciliation Bill omits most of.

Corporate tax rates individual tax rates and capital gains taxes are also on the negotiating table. The bill provides that taxpayers with AGI of 400000 or more and all trusts and estates would only be allowed to exclude 50 of the eligible gain. The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget.

As the budget reconciliation bill goes up for a final Senate vote real estate partnerships should be evaluating how to adjust to the potential tax changes. Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million exemption to the 2010 level which would be. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most of the proposed changes to the estate tax.

For now the federal estate tax exemption remains at 117 million for 2021. The giftestate tax exemption currently is 10 million adjusted for inflation 117 million in 2021. The draft legislation was expected to.

The proposal reduces the exemption from estate and gift taxes from. Revised Build Back Better Bill Excludes Major Estate Tax Proposals In late October the House Rules Committee released a revised version of the proposed Build Back Better Act. No Changes to the Current Gift and Estate Exemption Provisions Until 2025.

Learn more about the House Build Back Better Act including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals The House Build Back. Potential Tax Impact on Estate Planning. It is scheduled to revert to 5 million plus inflation in 2026.

Estate planning changes dropped from US budget reconciliation Bill. 107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax. Individual rate increases.

Starting January 1 2026 the exemption will return to 549. Major tax changes in draft reconciliation bill. Any tax proposal will likely be pushed into a reconciliation bill which will only require a 51-50 vote in the Senate that would be 50-50 tie with the deciding vote cast by Vice.

Senate Democrats Prepare To Tweak House Reconciliation Package

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda

New Taxes Will Hit America S Rich Old Loopholes Will Protect Them The Economist

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Property Tax Breaks Would Be Restored Under Senate Budget Bill Menendez Says Nj Com

How The Tcja Tax Law Affects Your Personal Finances

Enjoy Your Eight Year Temporary Federal Tax Cuts

The Tax Cuts And Jobs Act Doesn T Comply With The Byrd Rule Committee For A Responsible Federal Budget

The Tax Cuts And Jobs Act Doesn T Comply With The Byrd Rule Committee For A Responsible Federal Budget

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Everything In The House Democrats Budget Bill The New York Times

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Meet The Republicans Who Voted No On The Tax Bill Roll Call

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

Virginia Democrat Introduces Bill To Impose 1 000 Percent Tax On Assault Style Weapons The Hill