tesla model y tax credit irs

For SUVs the maximum MSRP is. Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal tax credit.

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

While the former is priced starting at 67990 the latter has a starting price-tag of 69990.

. The Tesla Model Y is technically a small sports utility vehicle SUV which means it should qualify for the new EV tax credit based on price. The Act also gets rid of the manufacturer sales cap which was met by. The current federal tax credit for which Tesla no longer qualifies has no limit on the price.

Any vehicles purchased after that date are no longer eligible for the Federal credit due to the. That puts a Model Y LR with FSD over the limit even if sales tax isnt included if you add a color or the larger wheels. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019.

But maybe because of the battery cellmodule production. The Tesla Team August 10 2018. The current proposed legislation has many limitations including price of vehicle AGI of.

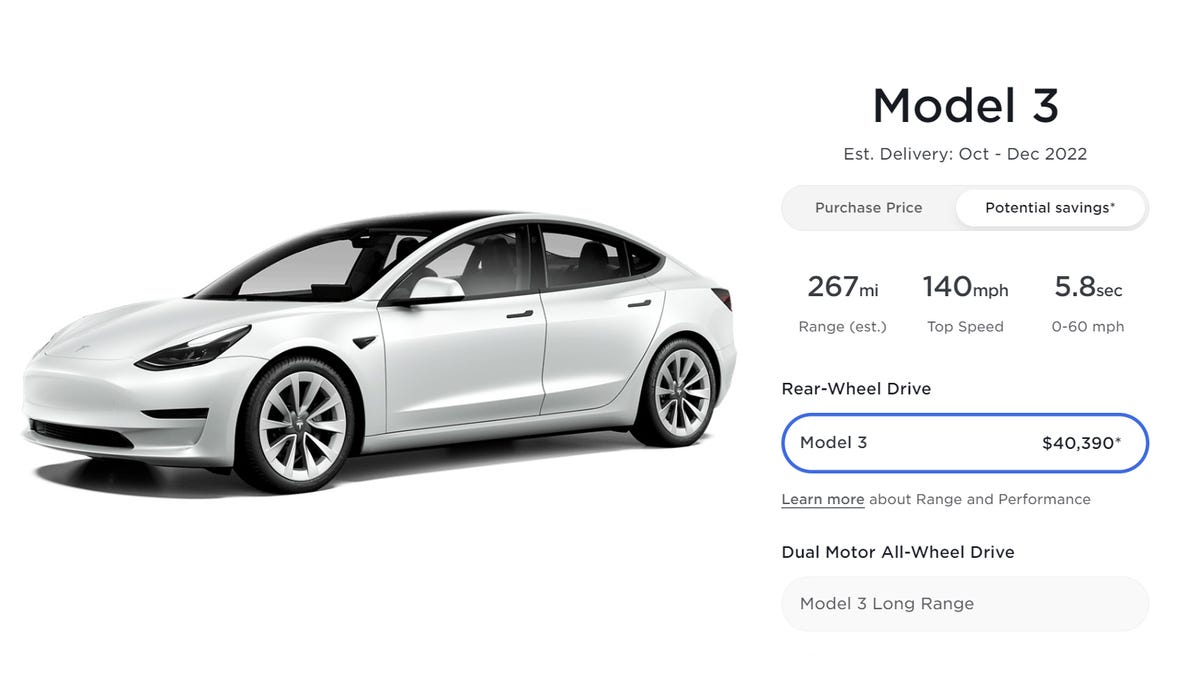

Since the new law would take the tax credits off the price of an EV at the time of purchase Tesla is making moves. If successfully passed the law could provide up to a 7500 tax credit for the Tesla Model 3 Standard Range and the Model Y so long as the buyer meets certain income limits. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus.

Model Y Tesla Versatile seating and storage for cargo and passengers Order Model Y Certain high data usage vehicle features require at least Standard Connectivity including maps. However Teslas can still qualify for up to 7500 in tax credits. This will ensure that both the Model Y Long Range and the Model Y Performance qualify for the tax credits.

Tesla Model Y 179 Deduction Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on Vehicles One year that are between 6000 Pounds and.

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax Credit News Cars Com

Breaking Ev Tax Credit Results It S Not Good Here S Why Youtube

2023 Bmw Ix Vs 2022 Tesla Model Y Comparison

Now Is The Worst Time To Buy A Tesla Here S Why Tom S Guide

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax Credit News Cars Com

Irs You Can Still Buy An Ev Or Phev In 2022 And Claim Tax Credit Only If It S American Made

Ev Tax Credit 2022 Changes How It Works Eligible Vehicles Carsdirect

Here S What The Ev Tax Credit For 2022 Means History Computer

Audi Mini Toyota Prius Models Added To Irs Electric Vehicle Tax Credit List Don T Mess With Taxes

New Ev Tax Credits Raise Fear Of A Messy Scenario For Car Dealers Automotive News

Before You Buy A Tesla New Tax Credit Edition Model S 3 X Y Youtube

Democrats Obstruct Their Electric Vehicle Push With Surprising Tax Credit Requirements

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Which Vehicles Qualify For New 7 500 Electric Vehicle Tax Credit Cpa Practice Advisor

New Electric Car Tax Credits Are About To Radically Change Buying Evs Cnet